Unlock Your Earning Potential: Explore Careers With A 45000 Salary

What is a 45000 salary?

A 45000 salary is an annual wage of $45,000. This equates to $3,750 per month, or $865 per week.

A 45000 salary is a comfortable wage in many parts of the United States. It is higher than the median household income in most states, and it provides a solid foundation for a middle-class lifestyle.

- Waukesha Library Events Resources

- Movierulz Today 2025 Your Ultimate Guide To Streaming Movies Safely And Legally

There are many different jobs that pay a 45000 salary. Some common examples include:

- Registered nurse

- Software engineer

- Accountant

- Teacher

- Sales manager

If you are interested in earning a 45000 salary, there are a few things you can do to improve your chances:

- Get a good education.

- Develop marketable skills.

- Network with people in your field.

- Be prepared to work hard.

With hard work and dedication, you can achieve your goal of earning a 45000 salary.

45000 salary

A 45000 salary is a significant financial milestone that can open up new opportunities and improve quality of life.

- Comfortable living: A 45000 salary provides a comfortable living in most parts of the United States.

- Middle class: A 45000 salary is typically associated with a middle-class lifestyle.

- Career advancement: Earning a 45000 salary often indicates career advancement and increased responsibility.

- Financial security: A 45000 salary provides a sense of financial security and stability.

- Homeownership: A 45000 salary can make homeownership more affordable.

- Education: A 45000 salary can help pay for higher education or other training.

- Retirement: A 45000 salary allows for more robust retirement savings.

- Generational wealth: A 45000 salary can help build generational wealth through investments and savings.

Overall, a 45000 salary represents financial success and the ability to live a comfortable and secure life. It is a testament to hard work, dedication, and career achievement.

1. Comfortable living

A 45000 salary provides a comfortable living in most parts of the United States because it allows individuals and families to meet their basic needs and enjoy a reasonable level of discretionary spending.

The cost of living varies from state to state, but a 45000 salary is generally sufficient to cover housing, food, transportation, healthcare, and other essential expenses. In many areas, it also allows for some discretionary spending on entertainment, dining out, and other activities.

For example, in the Midwest, a 45000 salary can provide a comfortable living for a family of four. The median home price in the Midwest is around $250,000, and a 45000 salary is enough to cover a mortgage payment, property taxes, and insurance. There is also enough money left over for food, transportation, and other expenses.

In more expensive areas, such as the Northeast or West Coast, a 45000 salary may not be as comfortable, but it is still possible to live on this income. Individuals and families may need to make some sacrifices, such as living in a smaller home or spending less on discretionary items. However, it is still possible to have a good quality of life on a 45000 salary in these areas.

Overall, a 45000 salary provides a comfortable living in most parts of the United States. It allows individuals and families to meet their basic needs and enjoy a reasonable level of discretionary spending.

2. Middle class

A middle-class lifestyle is generally characterized by a comfortable standard of living, financial security, and access to quality education, healthcare, and other essential services. A 45000 salary is typically sufficient to support a middle-class lifestyle in most parts of the United States.

- Homeownership: A 45000 salary can make homeownership more affordable, which is a key component of the American Dream and a cornerstone of middle-class wealth-building.

- Education: A 45000 salary can help pay for higher education or other training, which can lead to better job opportunities and higher earnings in the future.

- Retirement: A 45000 salary allows for more robust retirement savings, which can help ensure a secure financial future.

- Healthcare: A 45000 salary can provide access to quality healthcare, which is essential for maintaining a healthy and productive life.

Overall, a 45000 salary is typically associated with a middle-class lifestyle because it provides the financial resources necessary to meet basic needs, achieve financial security, and access essential services that contribute to a good quality of life.

3. Career advancement

Earning a 45000 salary is often a sign of career advancement and increased responsibility. This is because higher salaries are typically associated with more senior positions that require greater knowledge, skills, and experience. Additionally, employees who are promoted to higher-paying positions are often given more responsibility and autonomy in their work.

For example, an employee who is promoted from a junior accountant to a senior accountant may see their salary increase to 45000. This is because the senior accountant position requires more experience and knowledge, as well as the ability to manage a team of junior accountants. The senior accountant may also be given more responsibility for developing and implementing accounting policies and procedures.

Understanding the connection between career advancement and salary is important for several reasons. First, it can help employees set realistic career goals. If an employee knows that a certain salary is associated with a certain level of responsibility, they can work towards achieving that salary by developing the necessary skills and experience. Second, it can help employees negotiate their salaries. If an employee knows that they are being paid less than the market rate for their position, they can use this information to negotiate a higher salary.

Overall, the connection between career advancement and salary is an important one that employees should be aware of. By understanding this connection, employees can make informed decisions about their careers and their finances.

4. Financial security

A 45000 salary provides a sense of financial security and stability because it allows individuals and families to meet their basic needs, save for the future, and weather unexpected financial emergencies.

First, a 45000 salary allows individuals and families to meet their basic needs, such as food, housing, and transportation. This is essential for financial security because it ensures that people have the resources they need to live a healthy and productive life.

Second, a 45000 salary allows individuals and families to save for the future. This is important for financial security because it provides a financial cushion for unexpected events, such as job loss, illness, or a major repair. Additionally, saving for the future can help individuals and families achieve their long-term financial goals, such as buying a home or retiring comfortably.

Third, a 45000 salary allows individuals and families to weather unexpected financial emergencies. This is important because it helps to prevent financial setbacks from turning into financial disasters. For example, if an individual loses their job, a 45000 salary can help them to cover their expenses while they are looking for a new job.

Overall, a 45000 salary provides a sense of financial security and stability because it allows individuals and families to meet their basic needs, save for the future, and weather unexpected financial emergencies.

5. Homeownership

A 45000 salary can make homeownership more affordable because it provides individuals and families with the financial resources necessary to purchase a home and cover the associated costs, such as a down payment, mortgage payments, property taxes, and insurance.

In many parts of the United States, a 45000 salary is sufficient to qualify for a mortgage on a modest home. For example, in the Midwest, the median home price is around $250,000. A 45000 salary is enough to cover a mortgage payment of around $1,200 per month, as well as property taxes and insurance.

Homeownership is an important part of the American Dream and a key component of middle-class wealth-building. Owning a home provides stability and security, and it can also be a good investment. However, homeownership is not always affordable, especially in expensive areas. A 45000 salary can make homeownership more affordable for many individuals and families, allowing them to achieve their dream of owning a home.

6. Education

A 45000 salary can help pay for higher education or other training, which is an important component of career advancement and financial success. Higher education and specialized training can lead to better job opportunities, increased earning potential, and greater job satisfaction. For example, an employee with a 45000 salary who earns a master's degree in their field may be able to qualify for a promotion to a higher-paying position. Additionally, employees with specialized training may be more likely to be promoted and to receive higher salaries than those without specialized training.

Investing in higher education or other training can also lead to greater job satisfaction. Employees who are more educated and trained are more likely to be engaged in their work and to find their jobs more meaningful. This can lead to increased productivity and a more positive work environment.

Overall, the connection between education and a 45000 salary is an important one. A 45000 salary can help to pay for higher education or other training, which can lead to better job opportunities, increased earning potential, and greater job satisfaction.

7. Retirement

A 45000 salary allows for more robust retirement savings because it provides individuals with the financial resources to contribute more to their retirement accounts. Retirement savings are essential for financial security in retirement, as they provide a source of income to replace the income that is lost when an individual stops working. The more that an individual can save for retirement, the more secure their financial future will be.

There are many different types of retirement accounts available, such as 401(k) plans and IRAs. Each type of account has its own rules and regulations, but they all offer tax advantages that can help individuals save more for retirement. For example, contributions to a 401(k) plan are made on a pre-tax basis, which means that they are deducted from an individual's paycheck before taxes are calculated. This can result in significant tax savings, which can be used to invest more for retirement.

In addition to the tax advantages, many employers also offer matching contributions to their employees' retirement plans. This means that the employer will contribute a certain amount of money to the employee's retirement account for every dollar that the employee contributes. Matching contributions can be a valuable way to boost retirement savings, and they can make it easier to reach retirement goals.

Overall, a 45000 salary allows for more robust retirement savings because it provides individuals with the financial resources to contribute more to their retirement accounts. Retirement savings are essential for financial security in retirement, and they can help individuals to enjoy a comfortable and secure retirement.8. Generational wealth

A 45000 salary can help individuals and families build generational wealth through investments and savings. Generational wealth refers to the transfer of assets and financial resources from one generation to the next. Building generational wealth can provide financial security and stability for families for generations to come.

- Investing in the stock market

Investing in the stock market is a common way to build generational wealth. Stocks represent ownership in a company, and over time, the value of stocks can increase. Dividends are also typically paid on stocks, which provides a source of income that can be reinvested or used to cover expenses.

- Investing in real estate

Investing in real estate is another way to build generational wealth. Real estate can appreciate in value over time, and it can also generate income through rent payments. Rental income can be used to cover the costs of the property, or it can be reinvested to purchase additional properties.

- Saving for retirement

Saving for retirement is another important way to build generational wealth. Retirement savings can be invested in a variety of assets, such as stocks, bonds, and mutual funds. Over time, retirement savings can grow significantly, providing a source of income in retirement. Additionally, many employers offer matching contributions to retirement plans, which can help to boost retirement savings.

- Starting a business

Starting a business can also be a way to build generational wealth. A successful business can generate significant income, which can be used to invest in other assets or to pass on to future generations.

Building generational wealth takes time and effort, but it is possible to achieve with a 45000 salary. By investing wisely and saving diligently, individuals and families can create a legacy of financial security for generations to come.

Frequently Asked Questions (FAQs) about 45000 Salary

This section provides answers to some of the most frequently asked questions about earning a 45000 salary. These FAQs are designed to provide clear and concise information to help you better understand the implications and opportunities associated with this income level.

Question 1: What is the average cost of living for someone earning a 45000 salary?The cost of living can vary significantly depending on location and lifestyle. However, in many parts of the United States, a 45000 salary can provide a comfortable standard of living. It is important to consider factors such as housing costs, transportation expenses, and healthcare costs when determining your cost of living.

Question 2: Can I afford to buy a house with a 45000 salary?In many areas, a 45000 salary can make homeownership possible, especially if you have a good credit score and a stable employment history. However, it is important to factor in additional costs associated with homeownership, such as property taxes, insurance, and maintenance.

Question 3: What are the career prospects for someone earning a 45000 salary?Earning a 45000 salary often indicates career advancement and increased responsibility. Many professionals with this income level have the opportunity to move into management or leadership roles. Additionally, there are many industries where a 45000 salary is considered a competitive wage, providing opportunities for career growth and development.

Question 4: Can I save for retirement with a 45000 salary?Yes, it is possible to save for retirement with a 45000 salary, especially if you start saving early and take advantage of employer-sponsored retirement plans, such as 401(k)s. It is important to create a budget and stick to it to ensure that you are contributing to your retirement savings on a regular basis.

Question 5: What is the tax bracket for a 45000 salary?The tax bracket for a 45000 salary will vary depending on your filing status and the number of dependents you claim. However, in general, a 45000 salary falls into the 22% federal income tax bracket.

These FAQs provide a general overview of some of the key considerations for individuals earning a 45000 salary. It is important to note that individual circumstances may vary, and it is always advisable to seek professional advice to make informed financial decisions.

Transitioning to the next article section: This concludes our discussion on FAQs about a 45000 salary. In the next section, we will delve into strategies for maximizing your earning potential and achieving financial success.

Conclusion

A 45000 salary represents a significant financial milestone that can open up new opportunities and improve quality of life. It is associated with career advancement, financial security, and a comfortable standard of living. By understanding the implications and opportunities associated with this income level, individuals can make informed decisions about their careers and finances.

To maximize your earning potential and achieve financial success, consider the following strategies:

- Invest in education and skill development to increase your value in the job market.

- Explore career opportunities that offer growth potential and higher earning potential.

- Negotiate your salary and benefits to ensure you are fairly compensated for your skills and experience.

- Create a budget and stick to it to manage your finances wisely and save for the future.

- Seek professional financial advice to develop a personalized plan for achieving your financial goals.

Remember, financial success is not just about earning a high salary. It is about making smart choices, managing your money wisely, and planning for the future. By following these principles, you can achieve financial security and live the life you want.

- Telugu Movierulz Com 2025 Download Your Ultimate Guide To Movies And Beyond

- Kashmir 9 Unveiling The Secrets Of The 1990s

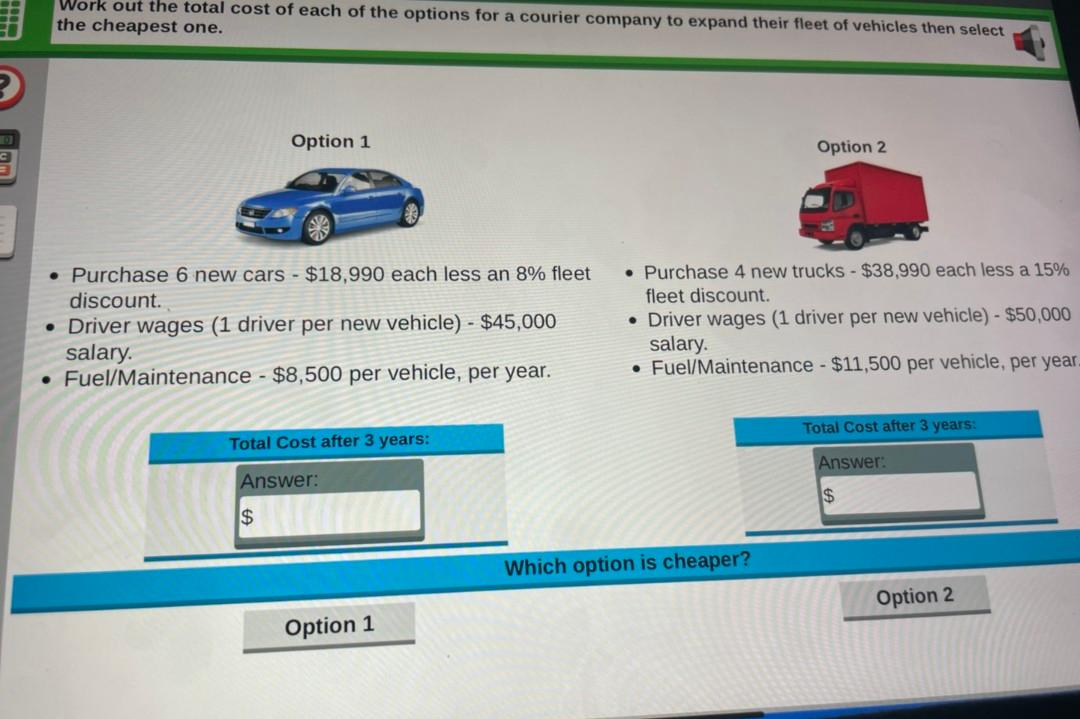

Solved Option 1 Purchase 6 new cars 18,990 each less an 8 fleet

Solved Work out the total cost of each of the options for a

Solved A man’s annual salary is 45000. His tax free allowances total